The State of Child Care in 2020: A Survey of 300+ Child Care Directors

Download WhitepaperThe Child Care Crisis in Context

In 2019, the Committee for Economic Development (CED) released a report, which found that there are 674,332 child care programs (centers and home-based sole proprietors) throughout the United States. Their revenue amounts to $47.2 billion, and they collectively employ 1.5 million workers.

Beyond direct jobs, the industry supports an additional 507,089 jobs within communities leading to an overall employment impact of 2 million workers.

The spillover impact of these programs generates an additional $52.1 billion in local economies, which is a $99 billion economic impact and contribution to GDP annually.

According to the same report, about 53.9 percent of children from birth to 5 in the US are in some type of non-parental care for at least 10 hours per week.

Families

As the COVID-19 pandemic struck the country, school and child care program closures kept children home. Now, as facilities remain closed and their attendance shrinks, child care, which was already a limited commodity, becomes even more finite. Research by the Center for American Progress predicted in April that the COVID-19 pandemic would put 4.5 million child care slots at risk of disappearing. Across the country, this amounts to nearly half of all available licensed child care slots.

For families, lack of access to child care often keeps parents out of the workforce in order to adequately provide care to children. Pre-pandemic, about two million parents faced job disruptions due to child care accessibility. Nationally, this loss of earnings, revenue, and productivity cost the economy $57 billion annually.

Notably, the child care crisis most often impacts women, who are 40 percent more likely to report they’ve experienced negative impacts from child care on their careers. For example, women comprise 45 percent of working parents with young children, but they represent 55 percent of parents who depend on child care to go to work or school. Now with widespread distance learning and limited child care availability, this stresses an already fragile employment environment, leaving families, and often women, to grapple with the precarious job balancing work and child care, or financial survival and child development.

As one parent explained, “We are burned out because we are being rolled over by the wheels of an economy that has bafflingly declared working parents inessential.”

Child Care Workers

Another side of this story is the child care workers who are facing job losses and reduced hours. These workers are 93 percent women and 40 percent women of color. With a median annual income of $22000, these jobs would fall close the lowest pay scale in many parts of the country. As employment opportunities are reduced, this puts extra pressure on marginalized groups or workers, which further fuels the financial challenges gripping many under the COVID-19 economy.

Students

Perhaps most importantly are the students who are at risk of losing valuable educational time. Early childhood education is critical for the development of social-emotional learning, literacy, and language skills, as well as providing safe, nurturing, and equitable spaces for young children. For example, children from lower-income families are especially susceptible to higher screen times, obesity rates, and poor nutrition amidst stay-at-home orders, whereas early childhood facilities would combat these trends and promote cognitive and academic development for all children.

Now, as schools brace to reopen doors, owners and directors of child care facilities must grapple with the financial challenges facing them in an industry that already ran on razor-thin margins. The benefits of reopening for parents, workers, and students are clear. But what does this process look like on the ground, and what has been the impact of COVID-19 at a program level in child care?

In partnership with California Quality Early Learning (CQEL), a nonprofit advancing quality early learning education, Curacubby commissioned a survey to answer these questions directly from child care providers.

Steven Khuong, Curacubby’s CEO, explains:

“While there has been a tremendous focus on public schools during the pandemic, it's not only worthwhile but critical that we begin to meaningfully examine how private school closures in early childhood education impact both the social-emotional development of our young children as well as the potential for a national economic recovery.”

Dave Esbin, CQEL’s Executive Director, adds:

“We’ve all heard the qualitative evidence of the hardships faced by child care providers. The stories are all narratives of struggle – struggle to stay afloat, struggle of deciding between educating children, enabling adults to get back to work, and putting staff and family health at risk, and struggle with deciphering a mountain of health and safety information. This is the first time that we have deep quantitative evidence of this struggle. It acts as a megaphone for how urgently the child care industry needs stimulus to continue educating young children and help America’s families get back to work.”

Survey Results

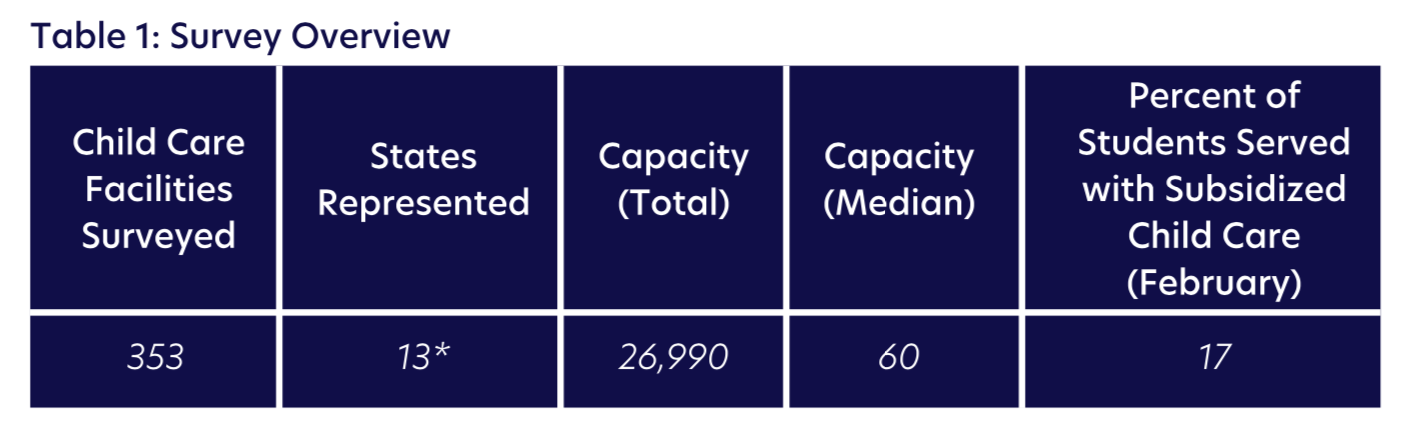

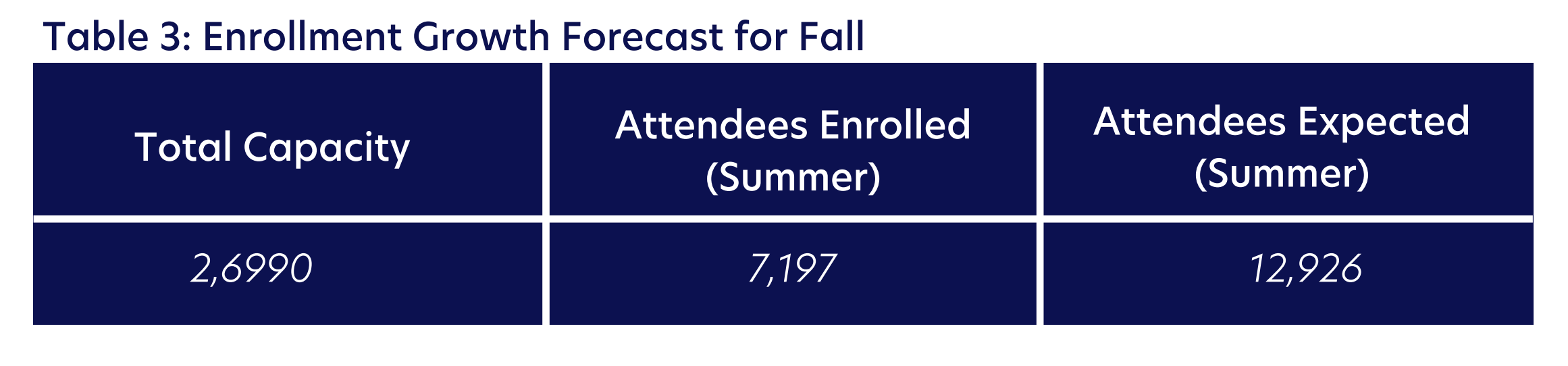

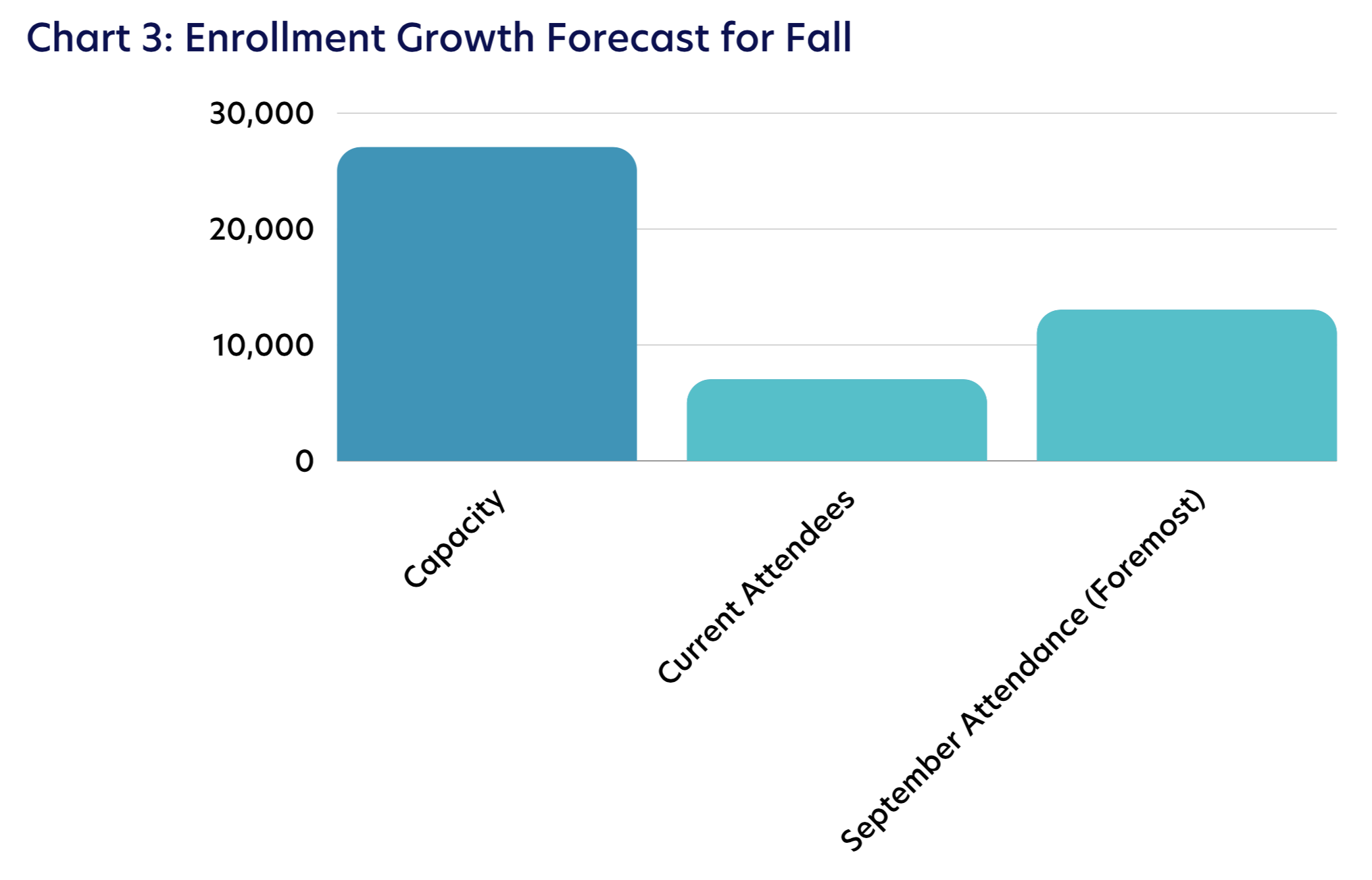

CQEL and Curacubby surveyed 353 child care facilities across 13 states, who collectively serve 26,990 students. The median capacity for each facility is 60 students, 17 percent of whom are subsidized attendees. All survey responses were recorded in July 2020.

*States: California, District of Columbia (DC), Illinois, Indiana, Maryland, Massachusetts, New Mexico, New York, Oregon, Pennsylvania, Texas, Virginia, and Washington.

Key Takeaways:

- Child care programs are operating at 27 percent capacity.

- Most programs have lost over a third of their revenue.

- The average child care would be financially insolvent in three months if they had to close for COVID.

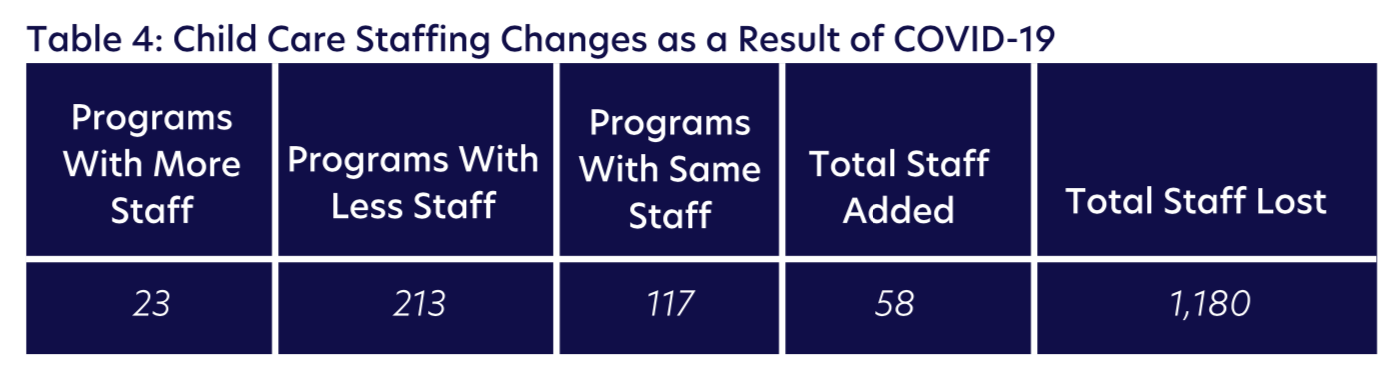

- The average child care has had to lay off a little less than half of its staff to survive the decrease in enrollment.

Current Operating & Attendance Levels

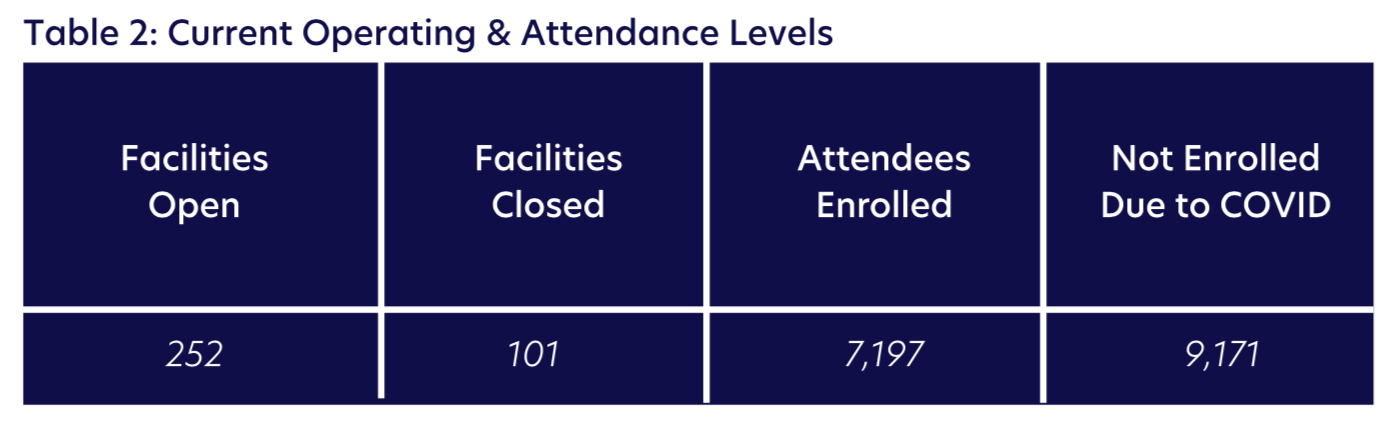

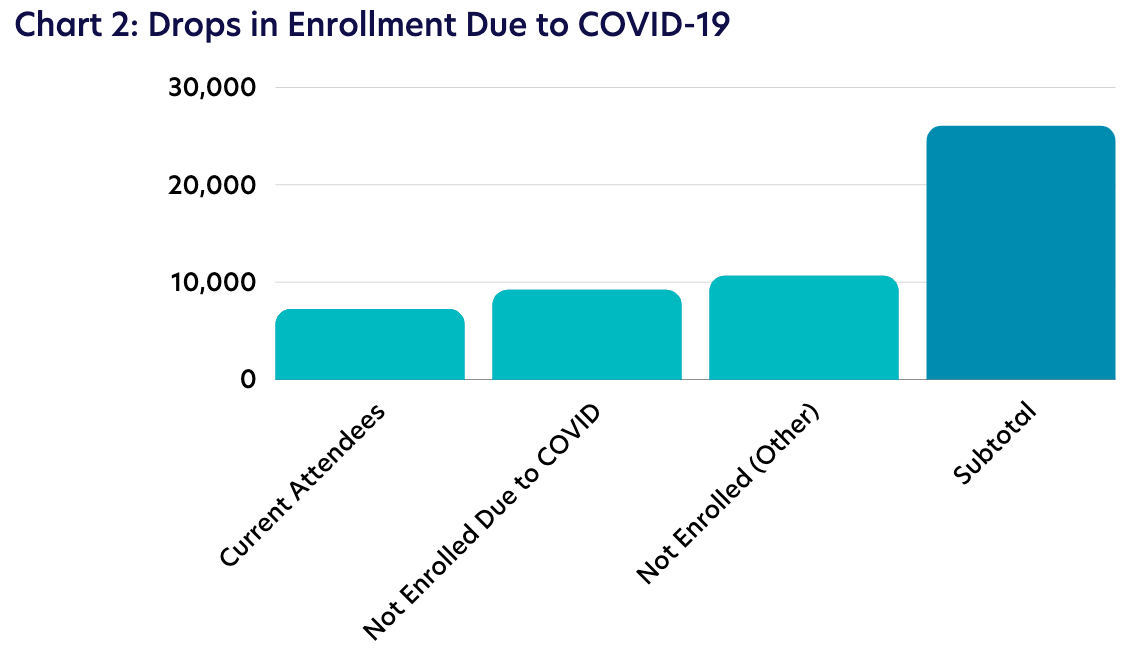

As of July, 71 percent of all facilities surveyed were open, while 29 percent had closed due to the pandemic. However, those operating are only able to fill less than a third of their enrollment capacity, and close to 50 percent of non-attendees have cited COVID-19 as the reason for not enrolling.

In raw numbers, this means that enrollment has dwindled from 26,990 to 7,197 students, leaving a gap of 19,793 attendees. Of these nearly 20,000 students who have opted to stay home, at least 9,100 have directly cited COVID as the reason for the decision. At the facility level, this results in 26 students (out of the median enrollment of 60) canceling due to COVID.

Now with the return of fall and the traditional back-to-school season, the surveyed child care programs expect to see an increase in enrollment, from less than a third of total capacity to about half capacity. At the program-level, this is a 50 percent increase from a median of 20 students to a median of 30 students.

Still, even with expected growth in attendance, these programs are expecting to operate at 50 percent capacity.

Staffing

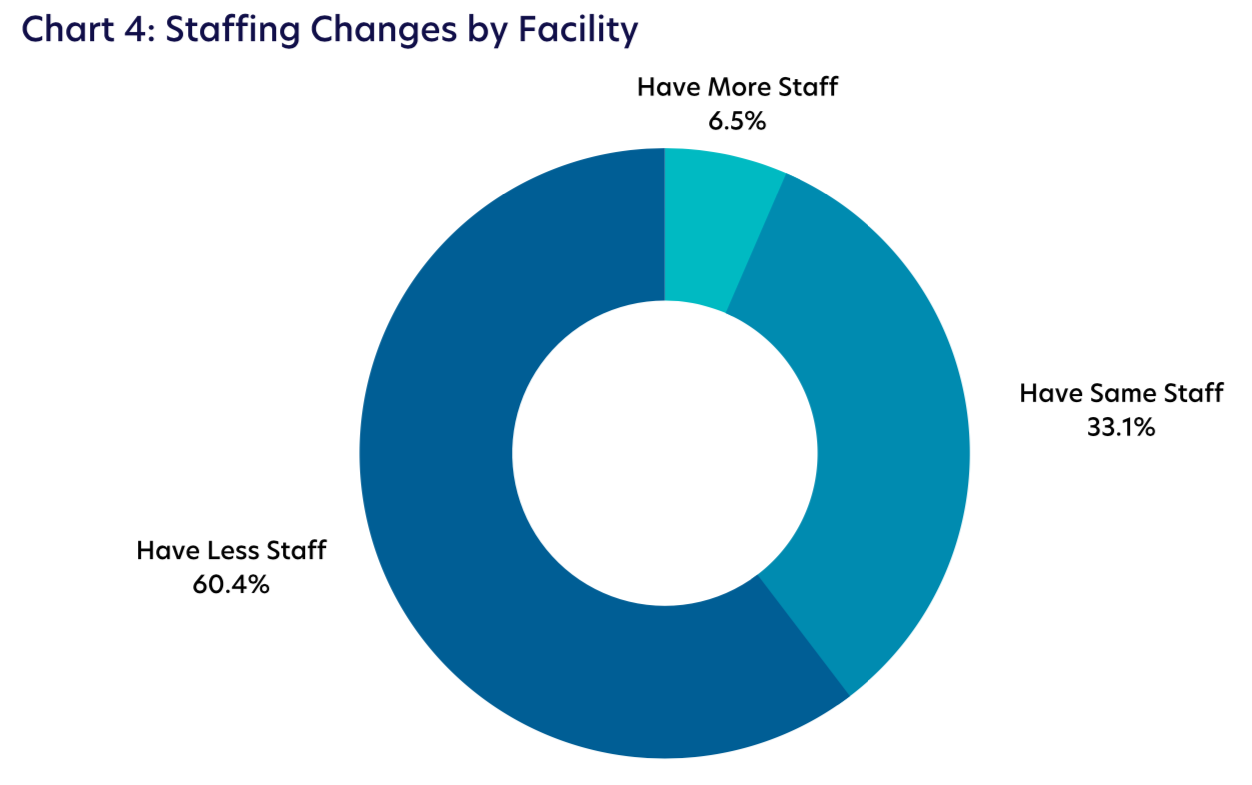

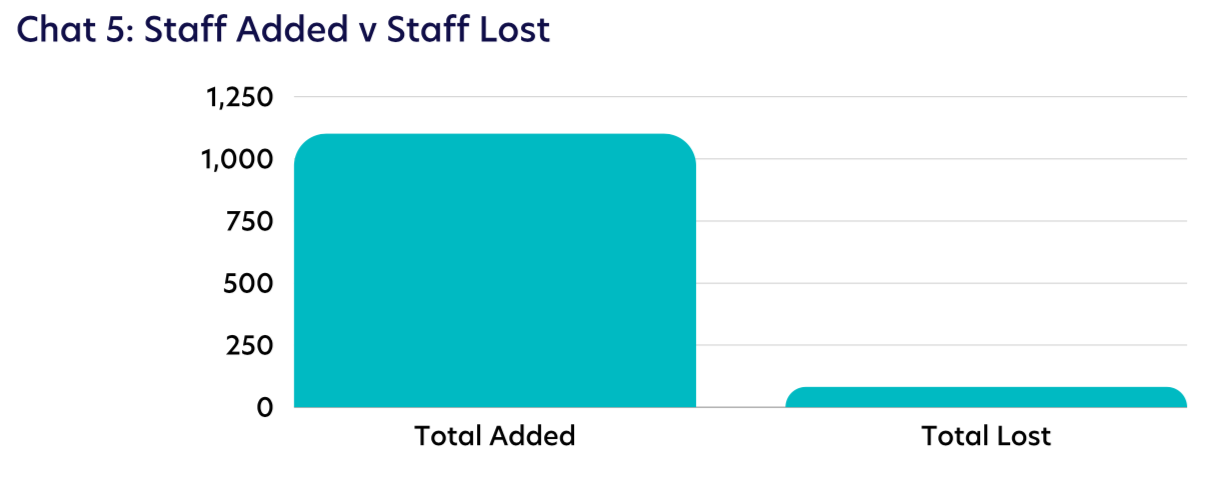

Perhaps not a surprise, the significant decrease in enrollment has generally led to a reduction in staff sizes as well. The programs surveyed laid off a total of 1180 staff, which is a median of four per facility that reported layoffs. However, it’s not all bad news. A smaller percentage of facilities did, in fact, cite staffing increases, which totaled 58 across respondents, or two per facility where new hires occurred.

Tuition Rates

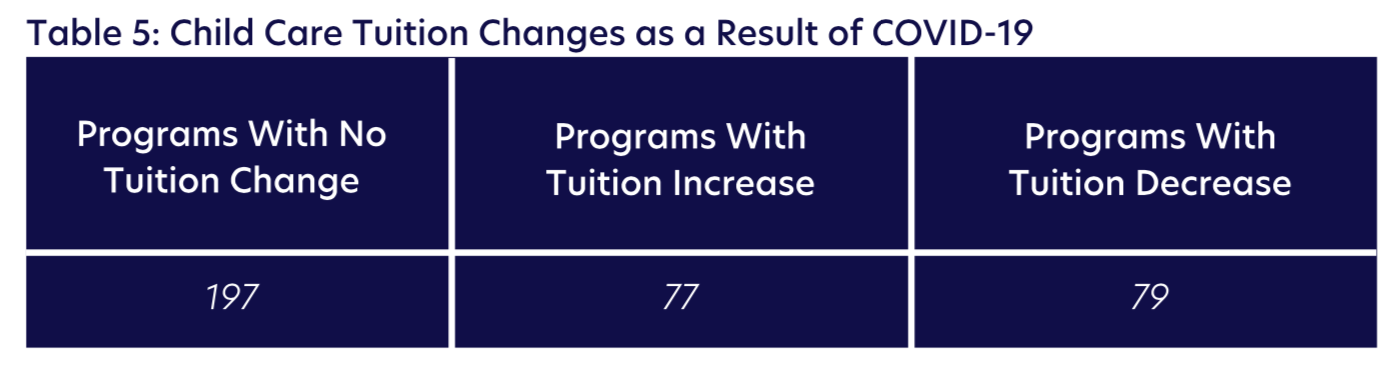

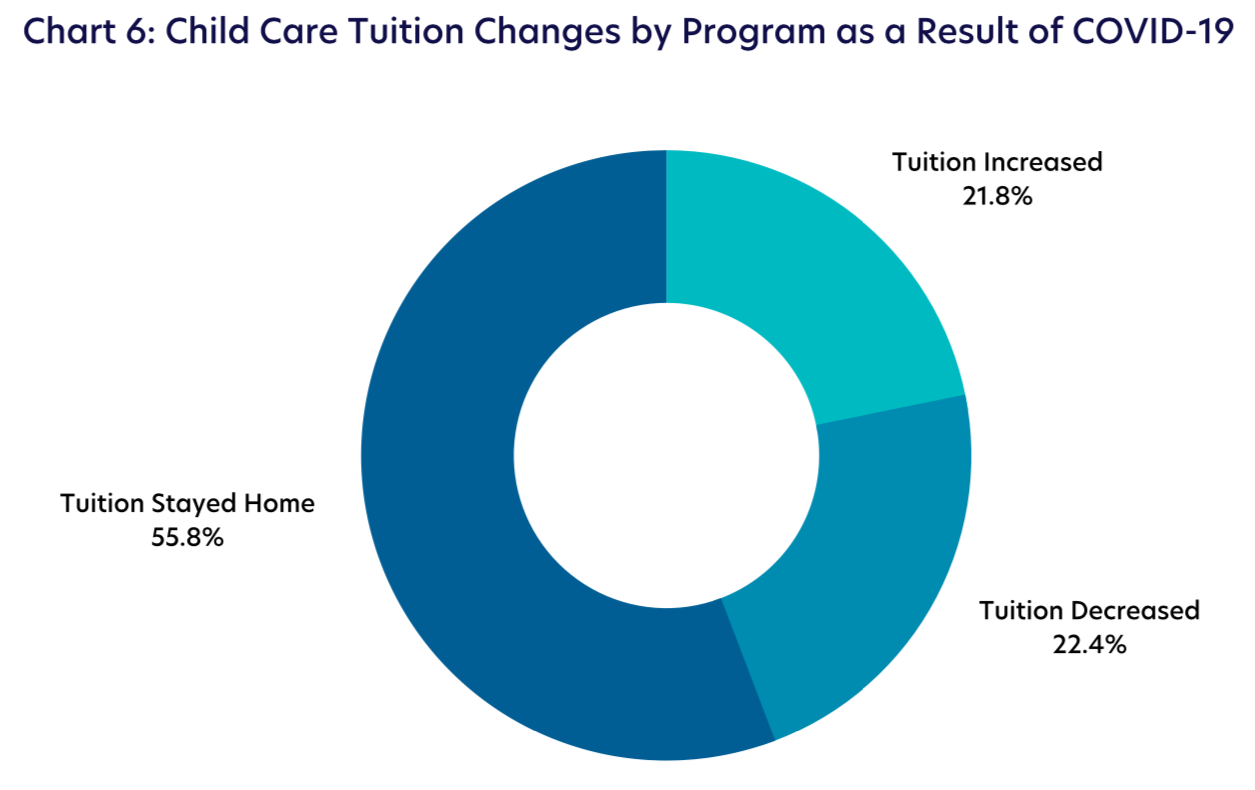

As the economic challenges of COVID-19 have deepened, some child care facilities have explored tuition changes as a result. These facilities are stuck in a difficult situation: their cost of operations is increasing, their overhead costs remain the same, but their revenue is falling due to lower rates of enrollment.

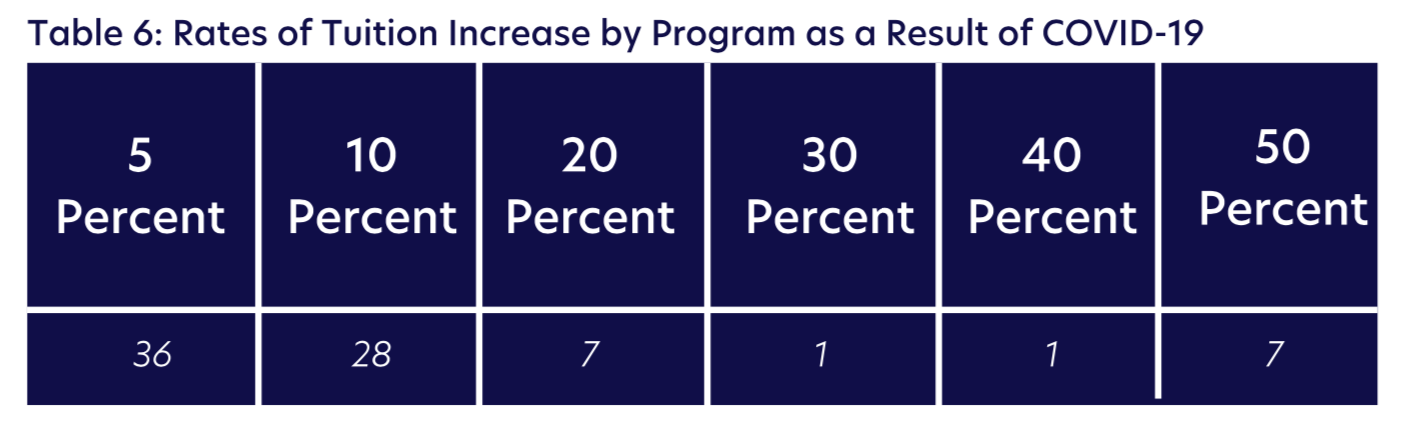

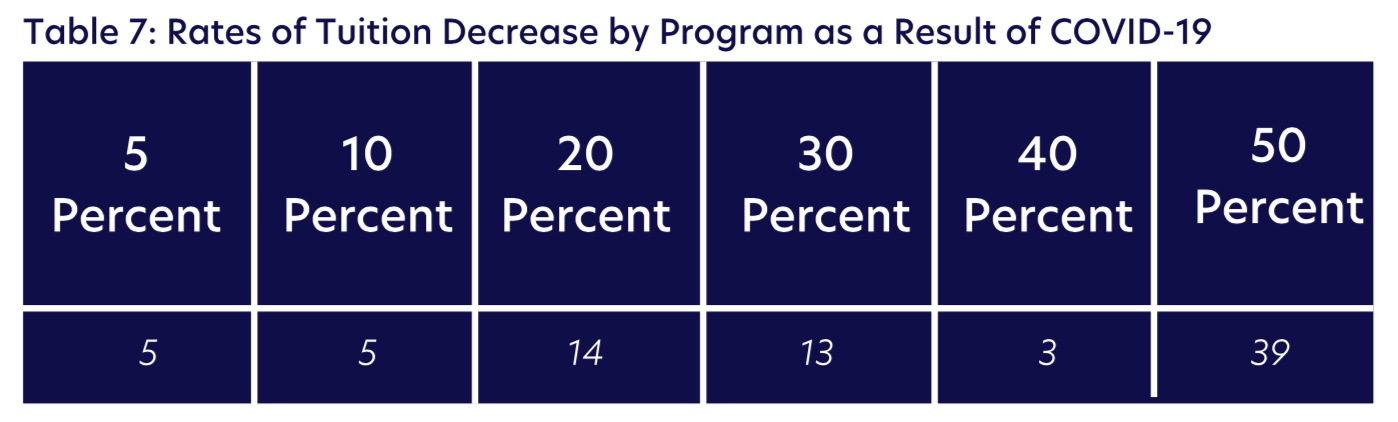

In about a quarter of cases, the programs increased tuition to cover new health mandates and make up for falling enrollment. On the other end, about a quarter of facilities also cited tuition decreases to help families afford child care despite financial challenges they may be facing.

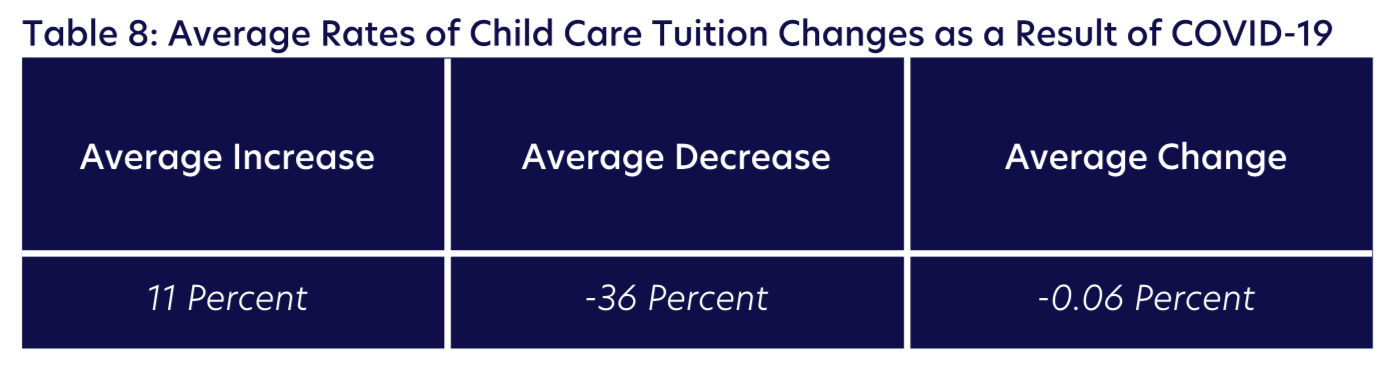

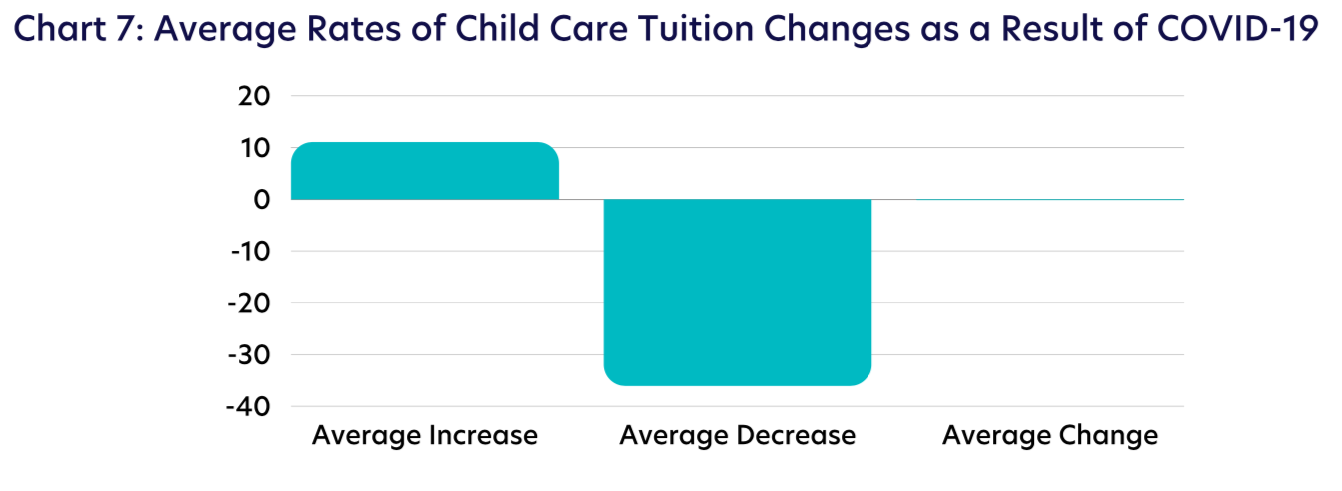

When we dive deeper into the rates of tuition change, we find that the average tuition increase was 11 percent, while the average decrease was about 36 percent. Across the board, the average change in tuition was just under a one-percent decrease. Moreover, tuition rates have generally fallen, though only slightly.

Funding Initiatives & Growth Plans

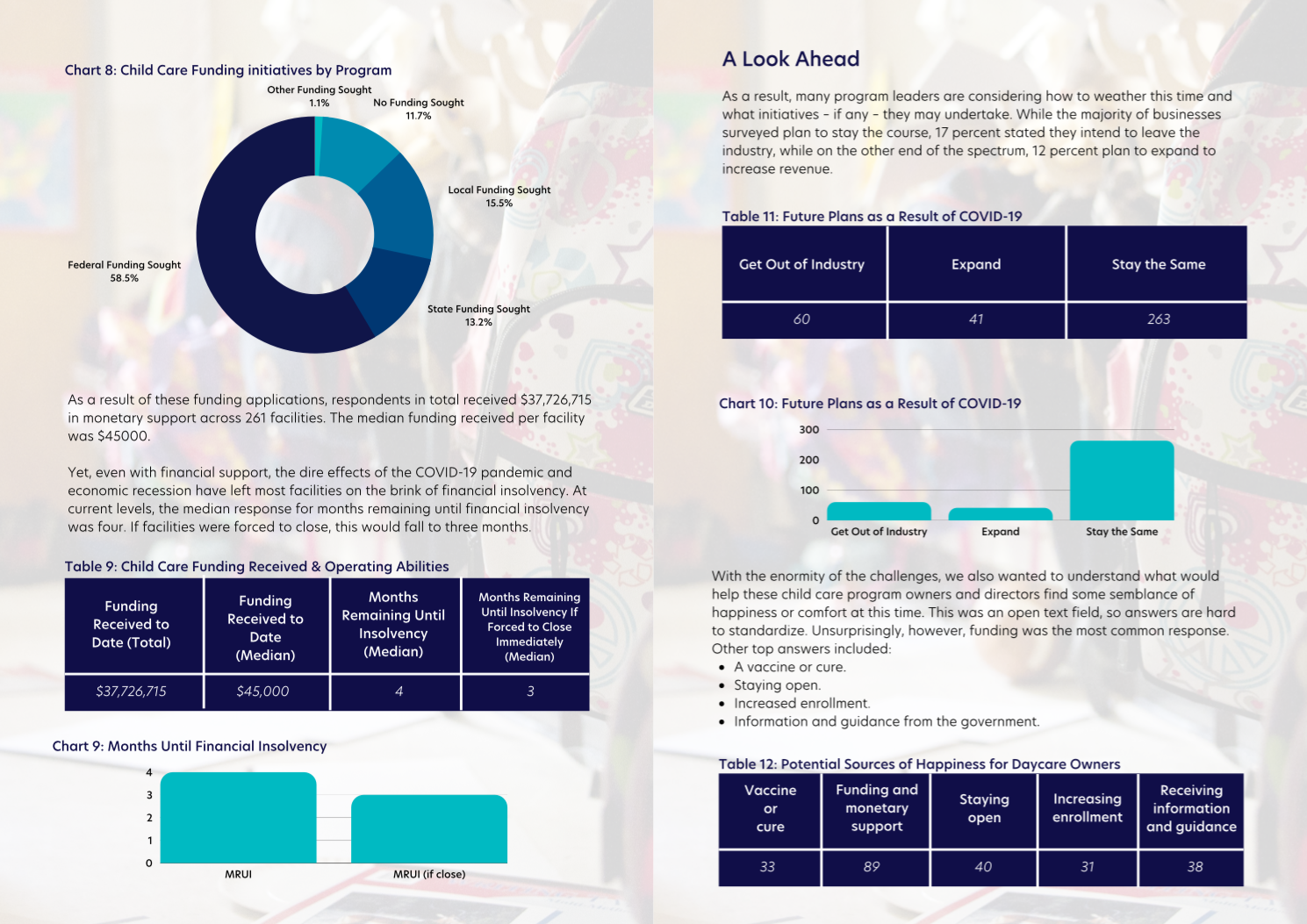

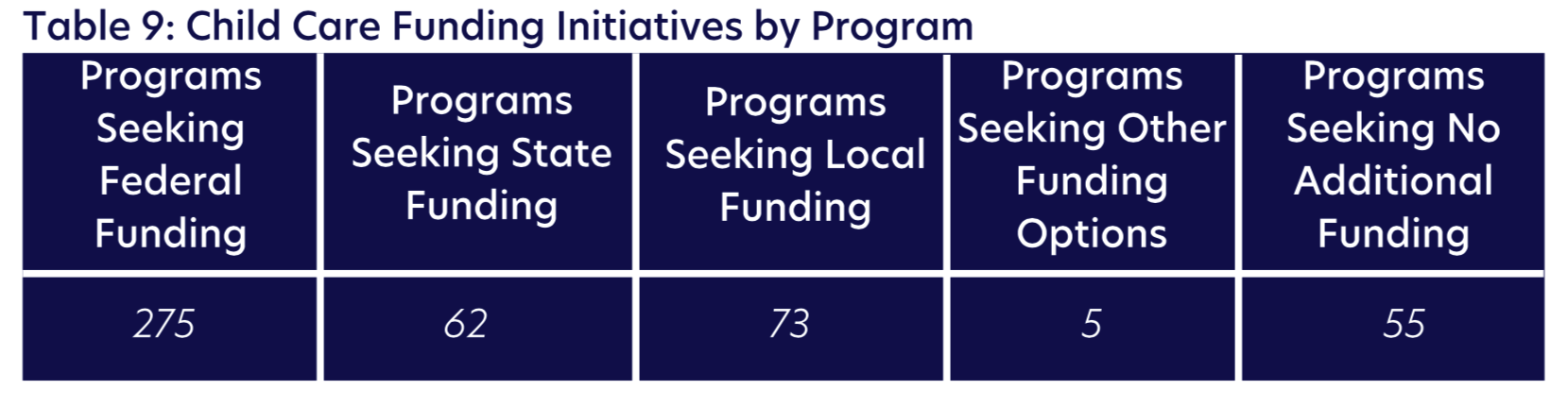

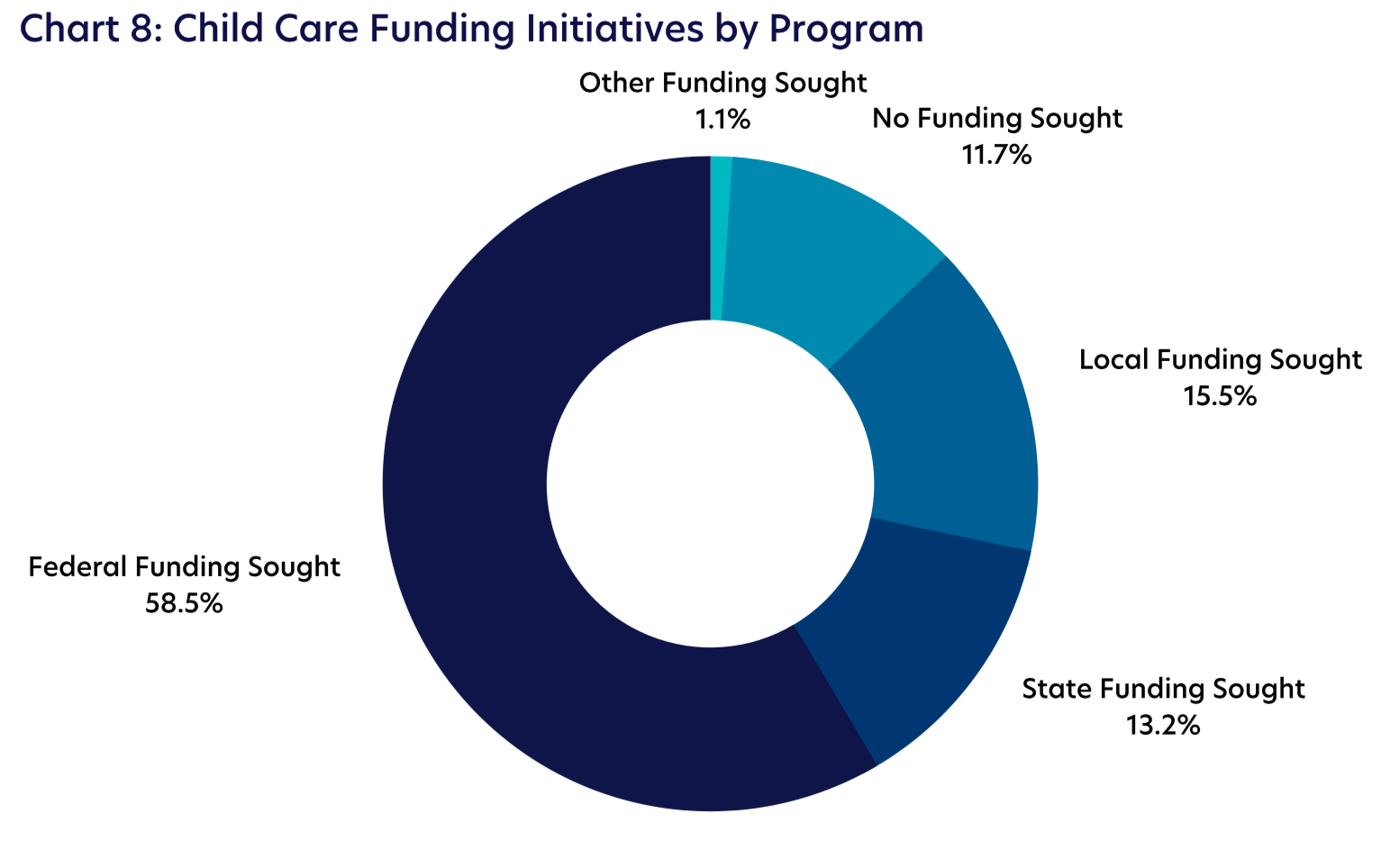

Besides increases in tuition or staffing changes, the majority (88 percent) of programs sought funding of some sort to manage financial challenges. For example, 78 percent of respondents sought federal funding, often from CARES or PPP, and close to 20 percent also applied for both state and local funding.

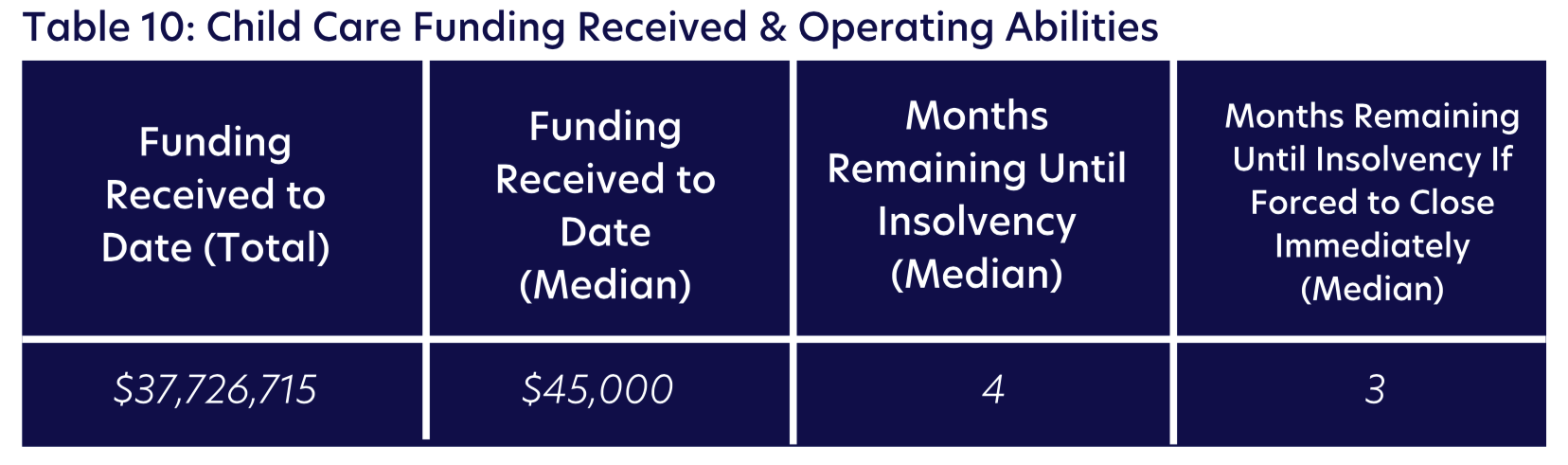

As a result of these funding applications, respondents in total received $37,726,715 in monetary support across 261 facilities. The median funding received per facility was $45000.

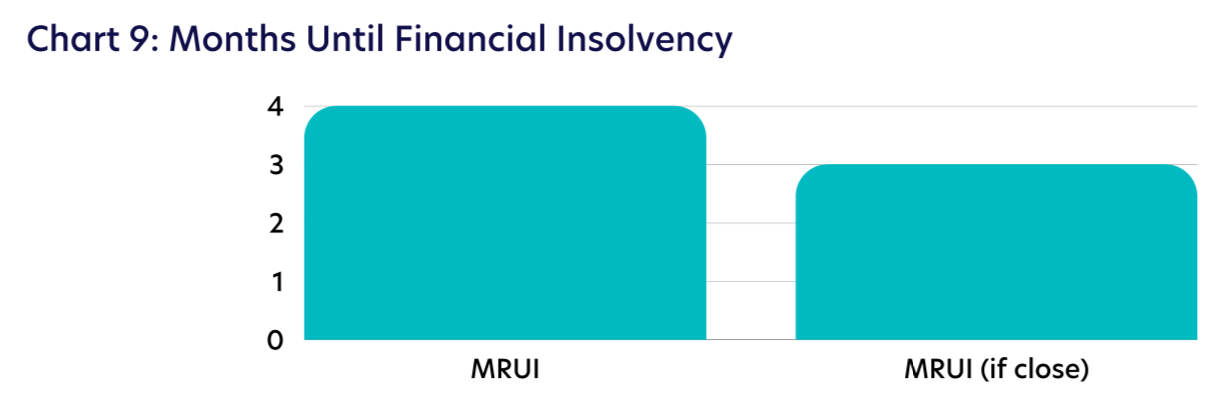

Yet, even with financial support, the dire effects of the COVID-19 pandemic and economic recession have left most facilities on the brink of financial insolvency. At current levels, the median response for months remaining until financial insolvency was four. If facilities were forced to close, this would fall to three months.

A Look Ahead

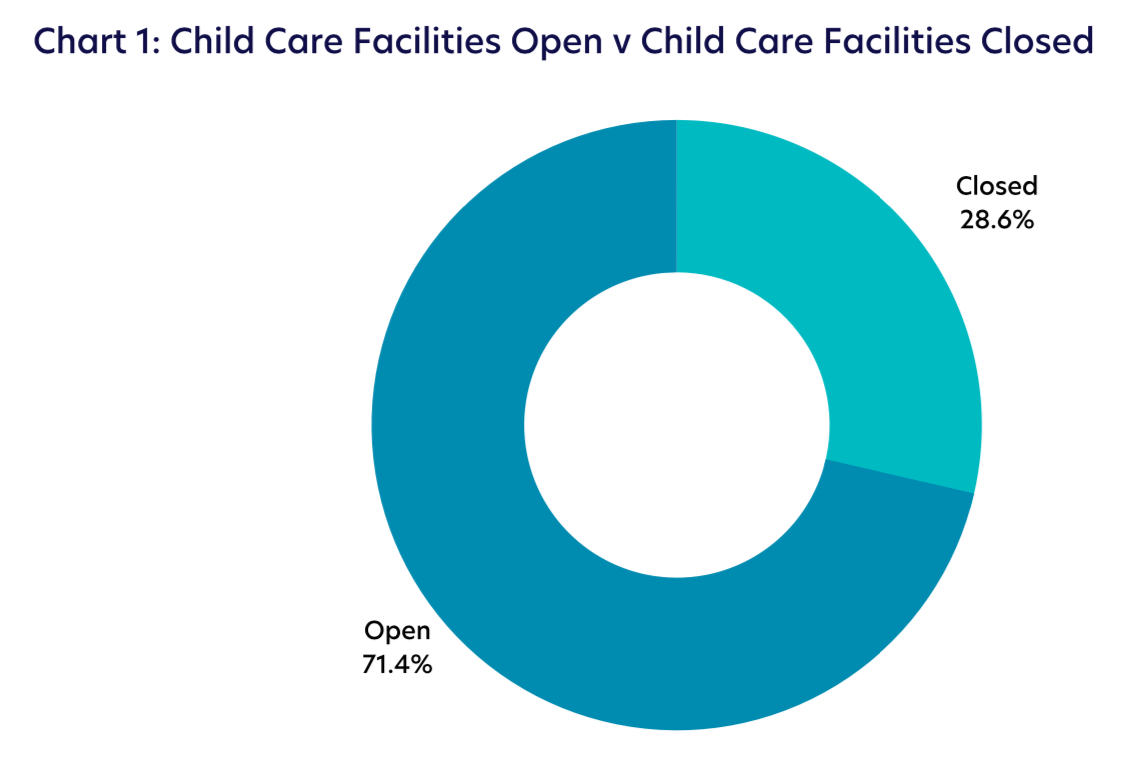

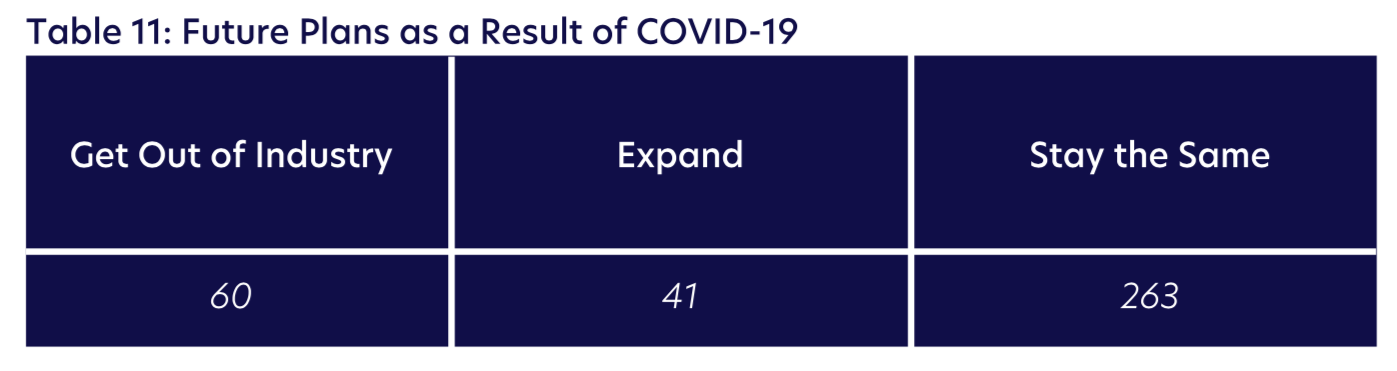

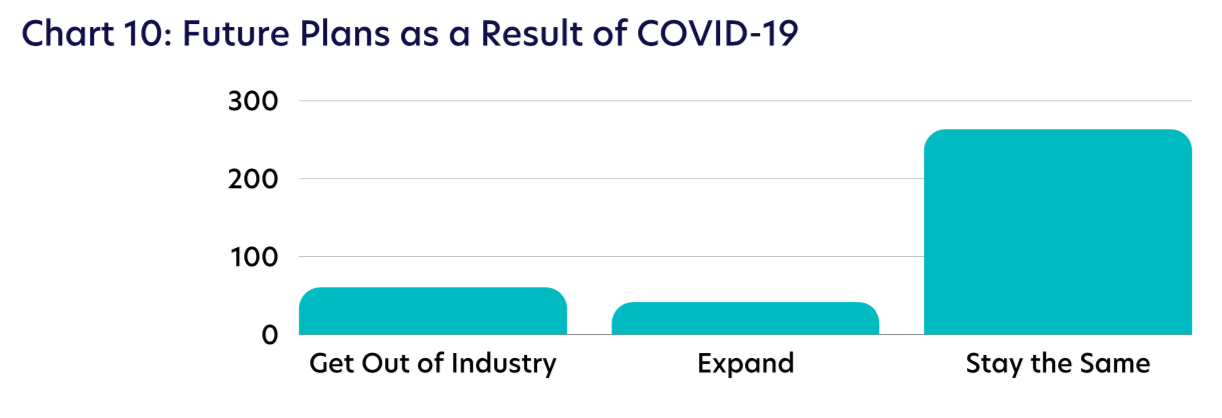

As a result, many program leaders are considering how to weather this time and what initiatives – if any – they may undertake. While the majority of businesses surveyed plan to stay the course, 17 percent stated they intend to leave the industry, while on the other end of the spectrum, 12 percent plan to expand to increase revenue.

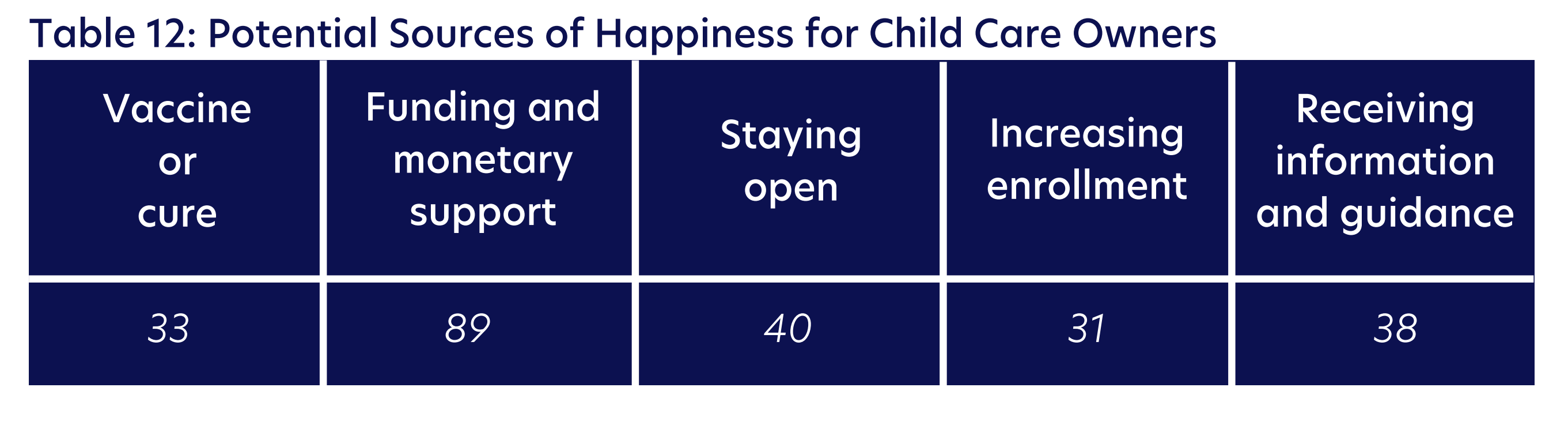

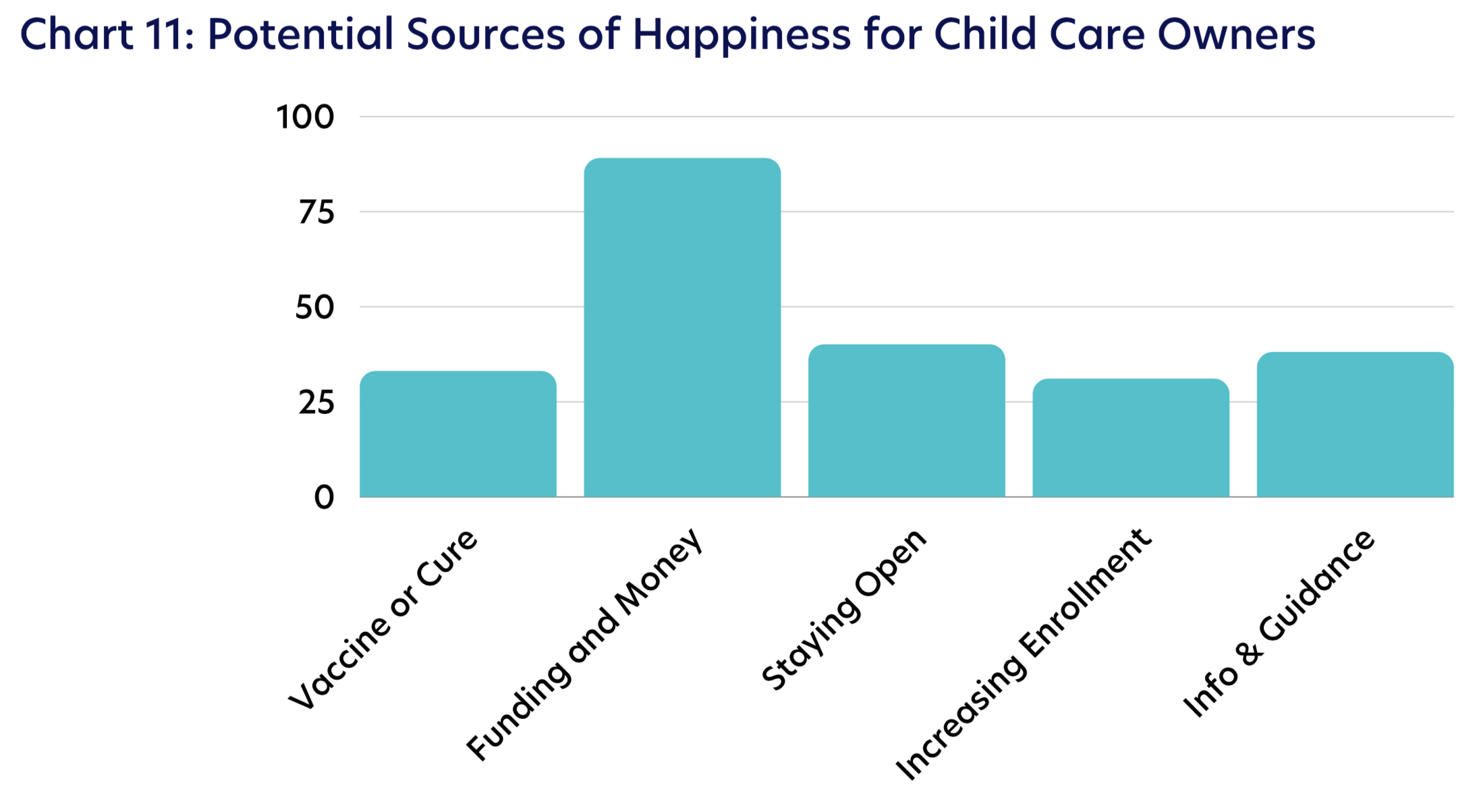

With the enormity of the challenges, we also wanted to understand what would help these child care program owners and directors find some semblance of happiness or comfort at this time. This was an open text field, so answers are hard to standardize. Unsurprisingly, however, funding was the most common response. Other top answers included:

- A vaccine or cure.

- Staying open.

- Increased enrollment.

- Information and guidance from the government.

Probing this further, we looked into strategies programs are employing to increase enrollment and meet new health and safety guidelines.

To increase enrollment, the top channels cited were word of mouth, online advertising and social media marketing, mail flyers, and website optimization.

To meet new guidelines, many programs are implementing extensive operational changes to improve health and safety. Specifically, we asked what the most difficult of these requirements and regulations were to achieve.

No surprise, the majority of the challenges revolve around meeting cleaning regulations, communicating with parents, keeping staff safe, and managing general time constraints.

And to make matters more challenging, surveyed respondents on average described acquiring adequate PPE and cleaning supplies as difficult, making reopening plans precarious.

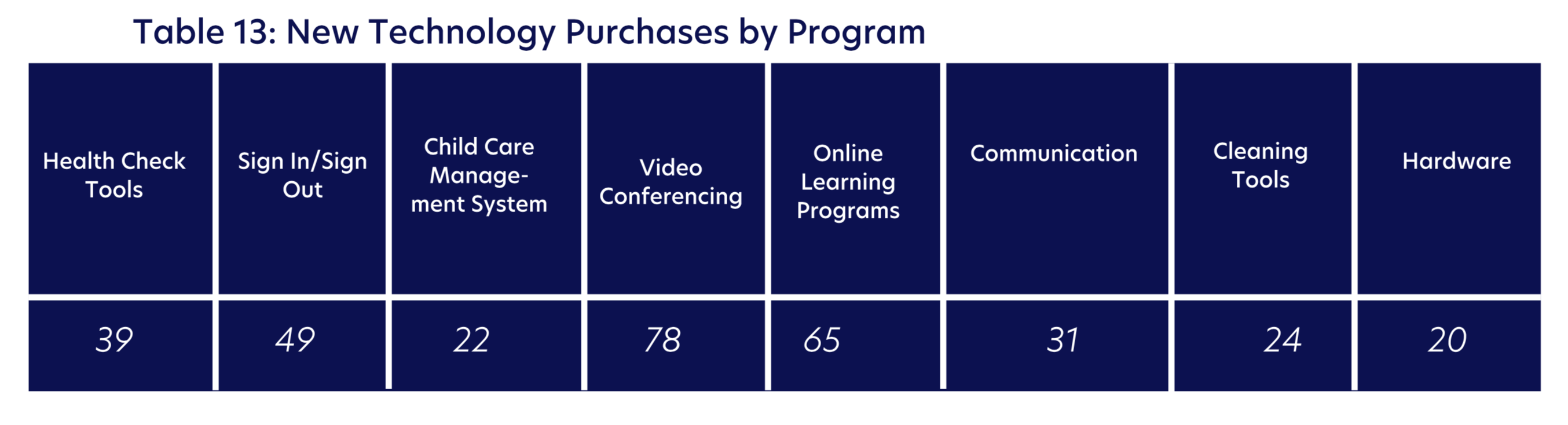

Finally, with the new mandates and growth initiatives, we also asked the respondents about the technology they are implementing to streamline operations across their schools.

The most common were online learning tools, like video conferencing and other digital education programs. There was also an outsized emphasis on digitizing business operations with tools like child care management software, online communication apps, and digital attendance tools.

What This Survey Says About the State of Child Care

Child care is a core function of our national economy: it contributes $99 billion to our GDP annually and generates employment for nearly two million workers, but it is also a critical enabler of working parents, allowing them – and especially women – to work and raise a family at the same time. And an already limited child care market pre-pandemic kept at least two million parents home annually.

Now, in the face of COVID-19, the future of child care is in flux, which means so is the future of our recovery. We are left to contend with questions like:

- If child care facilities shut down from economic troubles, what does this mean for working parents; and how would this change the dynamics of our workforce?

- What can we do to keep an industry employing two million people afloat, especially as it sustains more marginalized workers?

- And how do we support children in the critical years of cognitive development, when access and equity are our goals?

These are big questions with complicated answers, but this survey gives us the tools to begin to grapple with this dire situation – to turn anecdotal evidence into data. If we can quantify the struggle, we can commit to addressing it.